International banks which invested in mortgage market suffered horrible losses. As the confidence in the system began to shatter, several key events happened. Among the first to sense the impact were the government-sponsored enterprises Fannie Mae and Freddie Mac. They failure send warning to the entire banking industry that no one is too big to fail. When respected financial institution Lehman Brothers failed in September 2008, the negative spiral began to spread more quickly and the crisis hit the turning point. Panic occurred in the stock markets, causing stock prices to crash. Combination of numerous negative events led to the global credit freeze. Important institutions such as FED, ECB and IMF intervened in order to minimize the damage. However, we can still sense the aftermath of the subprime mortgage crisis even today. Find out more information here.

Prikazani su postovi s oznakom stock market crash. Prikaži sve postove

Prikazani su postovi s oznakom stock market crash. Prikaži sve postove

11/11/2011

11/07/2011

Panic of 1893

Panic of 1893 that ended an era of amazing economic growth is definitely a major event in the American history. Followed by violent strikes a new political balance was created while transforming national economy, as well as far-reaching social and intellectual developments. Railroads were overbuilt at the time, allowing speculative motives to come first. Numerous companies were continuing their growth by takeovers of competition, despite of the potential negative effects. The panic which eventually started in New York over the course of time spread over the United States of America. Read more about the Panic of 1893 aftermath here.

10/01/2011

Long depression of 1873 - part II

After the completion of the transcontinental Union Pacific Railroad in 1869, the public almost immediately requested another, called the Northern Pacific. Jay Cooke banking house needed to raise money for this project, but weakened economic conditions proved the Northern Pacific less attractive to investors. Since railroads were overbuilt, the competition was intense. Meanwhile speculation dominated in railroad securities, as well as in market in general. When the project failed, the connected companies fell as well. Panic started on the New York Stock Exchange forcing the bankers to close trading for ten days. The financial problems returned to Europe, causing a second panic in Vienna and numerous failures in continental Europe before receding. The Long Depression brought instability to the European countries, making international relations worse. For the next two decades, ripple effect from the crisis shook the economies. In the United States recovery began slowly in 1878, after many hardships endured. Read more about the consequences of Long Depression...

9/30/2011

Long depression of 1873

The Long depression was the first worldwide economic crisis, which happened in 1873. It began with a building boom in Europe, with massive construction levels taking place in Vienna, Paris and Berlin. In the United States the economy was also over-expanded, particularly in railroad construction. But after the Civil War the country needed rebuilding, therefore housing and construction levels grew quickly. Railroads were built at a record rate and everybody considered that this era of prosperity will never end. The idea of growth was destroyed in 1873, with stock market crash which started the Long Depression. The weak link turned out to be Jay Cooke and Company, a large and respected banking house. Cooke had played a large role in financing the Union war effort by marketing federal bonds to farmers and workers. After the war, the company had become the government's agent in financing railroad construction. However, one wrong decision regarding Northern Pacific Railway caused the demise of the banking house and started a nationwide depression. Read more about the Long Depression here...

9/05/2011

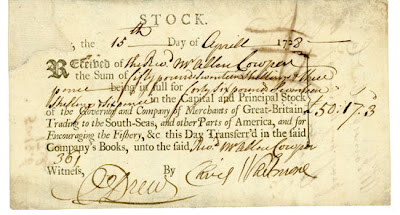

South Sea Company bubble

In the 1700s, the British Empire was the strongest force on the entire globe. The British South Sea Company was formed in 1711 and is considered as a prime example of a speculative bubble. The company was promised a monopoly on trade to the Spanish colonies and the prospect of exclusive rights to trade with new wealthy countries easily attracted more and more investors. Prices of shares spiked in January of 1720, from a modest £128 to £175 in February. With investor confidence mounting, the share price climbed to approximately £330 by the end of March. Speculation drove the price higher around £550 in May. When the South Sea company received the government charter by the end of June, which investors view as a vote of confidence in the company share price skyrocketed at £1050. And then came the collosal price fall that ruined hundreds of people and caused a nationwide crisis. Read more about the South Sea bubble here.

9/03/2011

Dot-com bubble

The dot-com bubble was a speculative bubble covering the period between 1995 and 2000. The bubble was a global phenomenon, which involved many international banks, mutual funds, venture capital, private investors from all over the world. Since public use of the Internet expanded rapidly over the years, Internet business seemed as an infinite source of profit and opportunity. Therefore a group of new purely Internet based companies commonly referred as dot-com emerged. New business paradigm suggested that the survival of the internet company depends on expanding its customer base as rapidly as possible, regardless of the financial result. For example, Google and Amazon did not see any profit in their first years. Amazon was spending money on expanding customer base and advertising and Google using the funds to create a more powerful search engine machine. These are, however, the shining examples. Many failures include NorthPoint Communications, Global Crossing, JDS Uniphase, XO Communications, and Covad Communications. Companies that produced network equipment such as Nortel, Cisco and Corning were at a disadvantage and also failed miserably. Read more about the dot-com bubble.

8/18/2011

Great Depression of 1929 - part V

The last part of pictures regarding the Great Depression concerns the actual beginning of the crisis. Massive speculation preceded stock market crash on Wall Street. Just before the collapse, economist Irving Fisher famously stated, "Stock prices have reached what looks like a permanently high plateau." As the optimism of the bull market shattered on Tuesday, October 29, he probably regretted those words. Almost all share prices on the New York Stock Exchange took a sharp dive. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor, determining that strong buy activity on leading blue chip stocks (U.S. Steel) could ease the panic. Most notable authority was the legendary J.P. Morgan. That action proved only a quick fix which lasted a day. The fall actually continued at an unprecedented rate for a full month. Investors began to despair, some even to the measure of taking their own lives. Others became crazy with euphoria and even tried gathering more money believing the crisis will be short. Read more about the stock market crash of 1929 here. You can also watch a documentary on Youtube of the ordinary people stories during the crisis, first part covering the circumstances of the Great Depression and the second part showing the hardship and the American culture of the period. Warning, some pictures are quite graphic.

Pretplati se na:

Postovi (Atom)